I Lost My Employer-Sponsored Health Insurance. Now What?

Have you just lost your health insurance due to mass layoffs at your company? In the course of lowering working hours, have you potentially lost some of your job-sponsored health coverage? The COVID-19 epidemic, which has affected millions of people across the world, extends you a 60-day Special Enrollment Period (SEP).

After 60 days have passed since your registration window closed, waiting for the next Open Enrollment Period to begin is the only option you have. In so many cases, this starts in November or unless there is another qualifying event under your name.

When it comes to lowering insurance costs, government subsidies (calculated in relation to your expected monthly income) can be of immense help here. The majority of Skyline Insurance customers enjoy a plan that costs $50 premiums or sometimes even less. And around 1/3 of their client base pay even cheaper than $10 per month in premiums.

Health Insurance Alternatives

There is a wide range of options available for you should you lose your health insurance coverage.

COBRA. As long as your employer’s insurance is in full force, meaning to say it is in effect, you are supposed to pay for it on your own. This, by a long shot, is the most expensive option, although you can expect that it provides full coverage together with access to the largest possible network of healthcare providers. It’s a safe bet that you’ll shell out anything from $200 to several thousand dollars every single month.

MARKETPLACE INSURANCE. The Patient Protection and Affordable Care Act is sometimes known as ACA health insurance. With respect to your monthly salary, the government may partially or completely cover your insurance premiums.

Although access to some doctors or healthcare professional service providers may be restricted, fundamentally, the service remains comprehensive. The lower your monthly payment is, the more money you’ll have to spend, so long as you qualify for subsidies.

Medicaid. The availability of free or low-cost health insurance for low-income individuals and families differs from one state to another (they always cover young kids and pregnant women). If you make an annual income of just under $25,000, you’re out of luck. You may spend anything from zero dollars to tens of thousands of dollars per month.

Medicaid. Low-income individuals and families have varying access to free or low-cost health insurance, but pregnant women and children are always covered. Those who earn just under $25,000 annually may not be accepted as eligible. As for the monthly expenditure, this may range anywhere between zero dollars to hundreds of thousands of dollars.

What About COBRA?

COBRA is nearly never advocated, as marketplace insurance is normally more cost-effective for the vast majority of people, even though sometimes subsidies are not fully available for them.

A qualifying life event is not a qualifying enrollment in COBRA, such as having a baby, moving, getting married, etc. Switching to a Marketplace plan must be done before the “Open Enrollment Period,” which begins on November 1st.

What Kind of Medical Insurance Do You Qualify For?

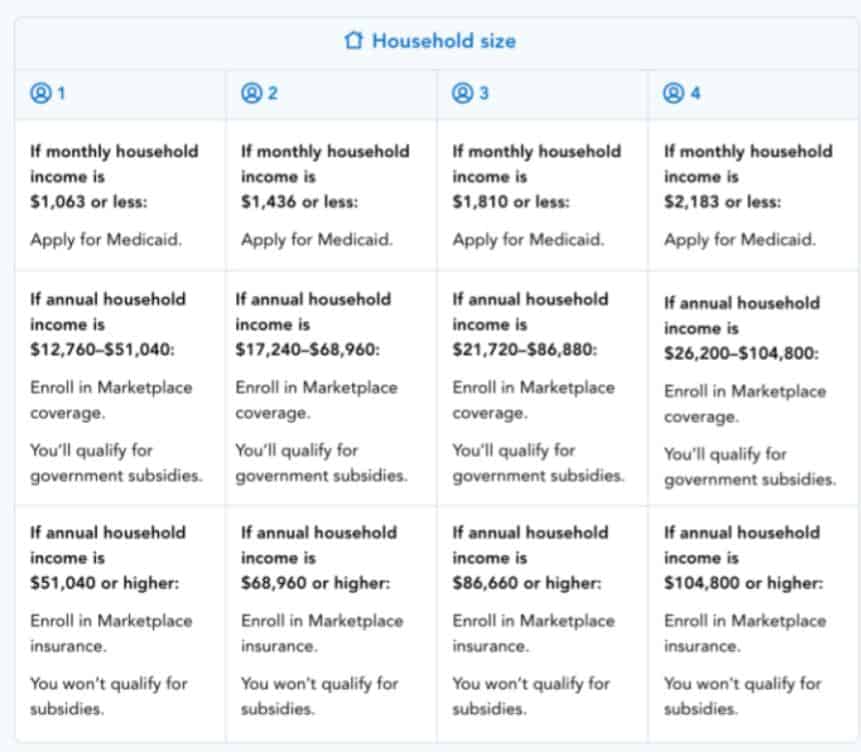

The number of people living in your household and your monthly income determines whether you’re eligible for subsidies through Health Insurance Marketplaces (HIM) and Medicaid or not.

States that have opted to expand Medicaid are shown in the following table how Medicaid coverage fluctuates with income. We can anticipate seeing the following:

In California, there is an exception to this rule because a middle-income subsidy is available. If you make up around $75,000 a year, you are so entitled to receive a subsidy.

Medicaid applications are available here.

The following states have not expanded Medicaid eligibility based on ability to pay:

KS, AL, WI, MO, NC, MS, TN, SD, TX, GA, OK, GA, SC, WY, FL.

People residing in states that did not expand Medicaid will realize that their income is just much too high to qualify for Medicaid but not high enough for them to become entitled to Marketplace subsidies.

You can find online application forms for Medicaid here.

You can visit this webpage instead if you are interested in Marketplace health insurance.

You can also enroll in health insurance through your spouse’s employer if their company offers so. So far, this is the most budget-friendly option there is.

- The first step is to sign up for health insurance through your spouse’s employer. You should take advantage of all opportunities that come your way because normally they’re the most cost-effective solution.

- COBRA is a costly blunder that should be avoided at all costs. It’s important to weigh all of your options before committing to a health insurance plan.

As a general rule, COBRA premiums are much more expensive as opposed to Obamacare, which is also recognized as Marketplace insurance. Subsidies for people who belong to the low-income bracket are part of the ACA as well, making health insurance more affordable. If you’ve enlisted in COBRA, you can’t switch to a Marketplace plan right away unless there is a Qualifying Life Event. If this is the case, there is no other route here to take than to stay on COBRA.

- Sign up for a Marketplace plan or Medicaid.

Uninsured individuals may suffer significant financial consequences during the COVID-19 epidemic. To put this into context, the average cost of hospitalization for Coronavirus infection is approximately $20,292. This hefty amount for treatment alone is a compelling reason to acquire health insurance. Contact us if you wish to enroll.

Depending on your monthly income and the state where you live, you may be entitled to Medicaid benefits. Medicare is a health insurance program for low-income Americans partnering with the federal government.

There are a handful of states that decided not to expand their Medicaid offering. Therefore if you happen to live in one of those states, you may not be eligible for Medicaid.

Medicaid covers one in every four children in the United States, 60% are patients in a nursing home facility, and 21% of adults in the low-income bracket.

Even if your income exceeds Medicaid’s limits, most people will be able to buy Marketplace insurance, thanks to subsidies and other incentives. Almost a third of Skyline Insurance Agency’s clients pay an average of $10 each month for coverage on the marketplace.

Every Marketplace plan and Medicaid that conforms with the ACA has robust health care coverage that encompasses it all from COVID-19 testing to emergency medical care, down to mental health and everything in between. Even women’s maternity care needs are also taken care of.

If you have reached your golden years, from 65 years old and up, we encourage you to sign up for a Medicare plan.