Shopping for health insurance can often be confusing and overwhelming, especially if you don’t understand how health networks work. They were really confusing to me before I became a Health Insurance Agent. I didn’t know what I was looking at, or what made sense, or anything. All I knew is that I kept getting frustrated at not know what I should be doing.

So, here are a few things to consider when deciding what health plan you should select.

Start with the Carrier

Here’s what I mean. Do you have a preference with what hospital or clinic you go visit? If not, then the carrier network doesn’t really matter. Here in Utah, Select Health is the largest carrier with the largest network. That means you can find a clinic or hospital just about anywhere you go. If you want to use an IHC (Intermountain Hospitals) then you should select a Select Health plan. If you don’t have a preference, you can choose any carrier based on these other criteria.

Does my Doctor take this insurance?

This is a pretty simple section to cover. Do you have a preferred doctor? If not, skip this section :). If so, let’s make sure he takes the insurance you’re about to sign up for.

Looking up a doctor is simple. Click on the carrier below and simply search for your doctor’s name. Or you can search by location and find a new doctor to go to.

University of Utah Doctor Look Up

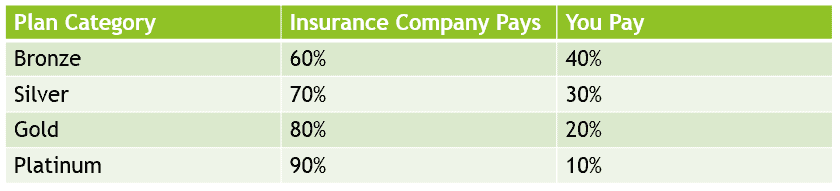

Bronze, Gold, Silver, and Platinum

What do those colors mean? Well, it’s a way to classify different plans within a carrier. The simple answer is, Bronze you pay a lower monthly premium, but pay more when you go to the doctor. Platinum pays a higher premium, but has less out of pocket expense when getting care.

There is alwasy a trade off in premium vs out of pocket expense. The lower the premium, the higher the out of pocket. Just like a teeter totter.

If you are relatively health and don’t go to the doctor that often, you may want to consider a Bronze Plan. Bronze Plans have the lowest monthly premiums, but higher out of pocket when used. But, if you don’t go to the doctor that often, not a big deal. You can pay for the doctor visit with all the extra money you’re saving with the lower monthly premiums.

Here’s a simple breakdown of you should expect to pay vs. what you should expect your insurance company to pay.

If you go to the doctor often, you may want to consider a Gold or Platinum plan. You’ll pay more each month in your premiums, but you can visit the doctor as often as you’d like knowing your out of pocket expense is much lower.

Special Events

One of most important things to consider (and sometimes it’s just a guess) is how often you’ll need to use your health insurance? Here is a list of Special Events in your life that could change how often you go to the doctor

- Having a baby

- Needing Surgery

- Your Current State of Health

- Age of your Children

- Turning 65, going on Medicare

Get some help, it’s FREE

There are many options to consider when selecting the right health insurance plan for you and your family. Consider working with a Health Insurance Expert to help you make the right decision, to get the right coverage, and find a plan that works best for you. Best of all, there is no additional charge for working an Agent. Curious as to Why you should use an Agent?